Avoid Cash Back at ALL costs.

“Evil” is an understatement.

I know this might be a weird thing to hear, since the majority of the credit card companies out there preach cash back like it’s the greatest thing since sliced bread.

You might hear 2% cash back and think “WOW, what a great deal!”

But the reality couldn’t be further from the truth.

The easiest way for me to explain this is with a quick example of what kind of value you can expect to get with cash back vs points.

So let’s get into it!

In cash back world, it’s not hard to get 2% back on average for whatever amount of money you spend on your credit cards.

So let’s say you’re able to spend 60k in a year, doable including all your bills, expenses, food, etc.

That would result in $1,200 of cash back total at the end of the year.

Cool, I guess. Not a bad proposition to get free money like that, considering you just spent like you’d normally spend.

But check out a points example instead. And to clarify, we’re talking about the GOOD kinds of points here. Transferable currencies like Chase Ultimate Rewards, Amex Membership Rewards, etc…

On those same 60k a year of spend, we can easily get 1.5x points per dollar in the currencies I mentioned above.

So that would result in 90k points at the end of the year. Also cool, but what does that even mean?

What can 90k points even get you?

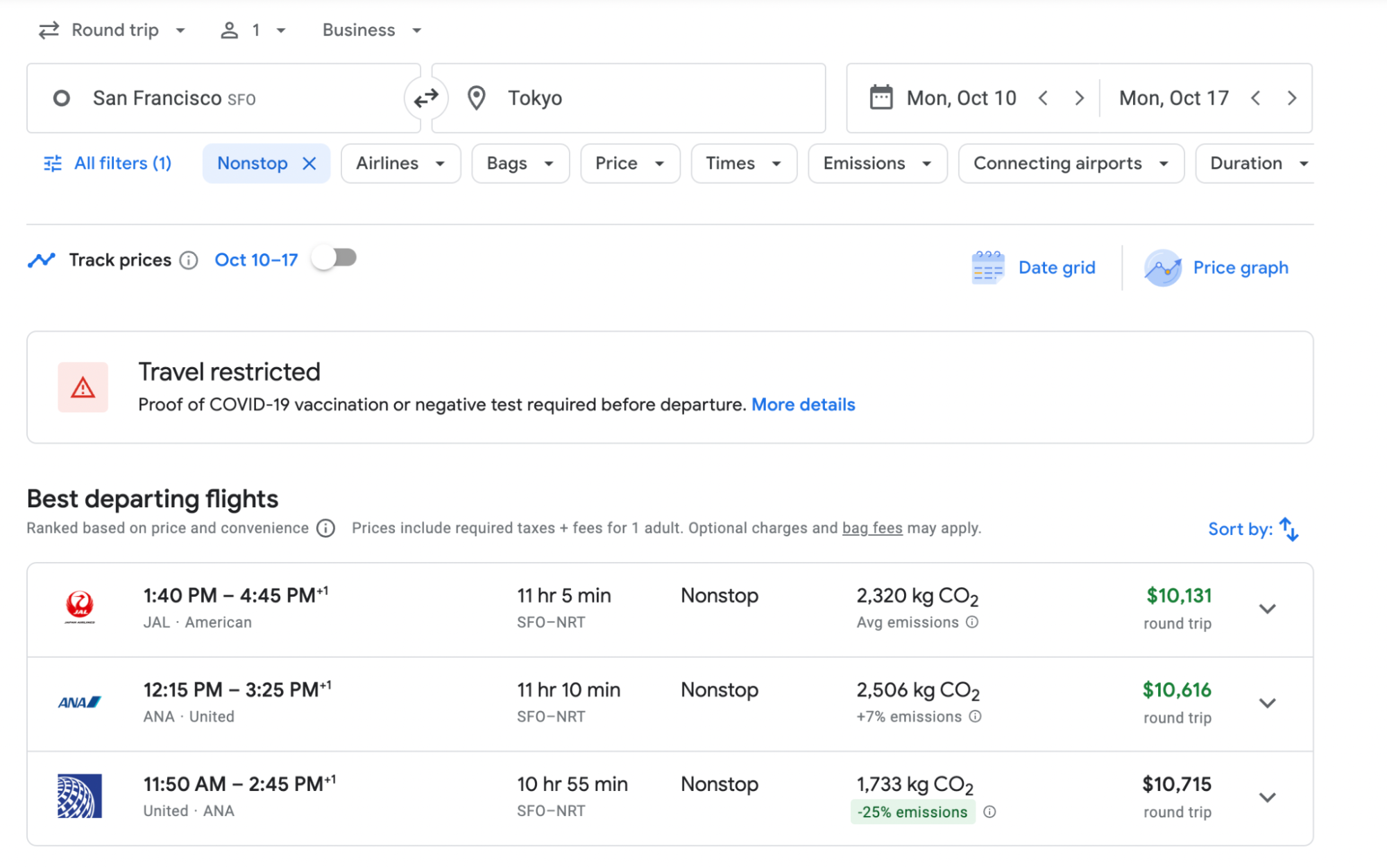

Let me show you. In this example below, you can see a flight from San Francisco to Tokyo in Business Class, Non-Stop:

On various dates, it’s between $8,000-$11,000 round trip. Kinda expensive, I’d say.

With cash back, you’d have to spend that same 60k annually for like 7 years to get close to affording ONE ticket if you’re receiving $1,200 a year of cash back rewards….

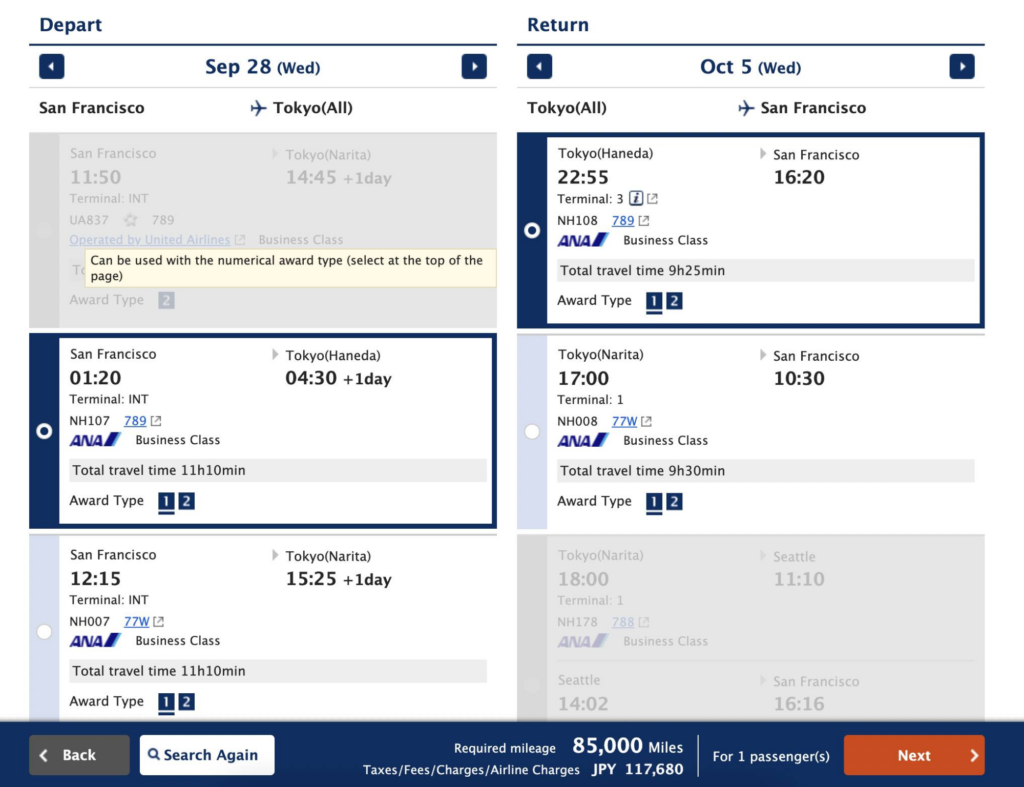

But on points? Let’s see one example of what this could cost just by understanding my methods of redeeming points.

Only 85k points ROUND-TRIP!

If you took the points route, you’d still have 5k points left over, and would’ve gotten an $8,000+ flight for very close to free.

Seems like a no brainer to me.

The point of all this is that cash back LIMITS your potential. It caps what you could possibly earn at a fixed rate, and won’t ever get better.

Meaning, you’re probably not gonna get any incredible luxury trips with that cash back any time soon. Unless you wanna wait 7 years…

All you gotta do is just make some changes to what you ALREADY do in your daily life and learn the game.

My top recommended card – Chase Sapphire Preferred® Card

For those stepping into the world of travel rewards cards, the Chase Sapphire Preferred is hard to beat. Its combination of an affordable yearly fee and generous welcome offer makes it an ideal starting point. The Chase Ultimate Rewards points you earn are among the most valuable in the industry.

The perks are substantial: You'll get a yearly $50 credit for hotels booked through Chase Travel℠, plus accelerated earnings with 5X points on travel purchases made through Chase TravelSM. Dining enthusiasts will appreciate the 3X points at restaurants, while all other travel spending earns 2X points.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.